Your call may be recorded for quality and training purposes

by: Dan Montague, VP Sales, International

“Your call may be recorded for quality and training purposes”

We’ve all heard that announcement at the start of an interaction with our bank, or our mortgage lender. But how do those organisations ensure that those recordings happen? And what are the consequences – both financially and from a customer experience perspective – if recordings fail?

Reasons for recording assurance

The recording of calls and interactions can be a mandated compliance requirement, but also is often a deliberate method of improving both agent/trader and customer experience. Calls can be used for training purposes and is a great way to improve the customer services that you provide.

Call recording compliance

Organisations that are subject to compliance regulations must be able to demonstrate to their local regulator that they are doing all that they can to ensure recordings are made, stored and available. If not, they must take steps to proactively notify the regulator of a failure to comply.

- FCA compliance: UK – The Financial Conduct Authority (FCA) states that firms must keep recordings of communications that might result in a transaction for a period of at least six months from the date the record was created. Read more about FCA compliance.

- SEC compliance: US – The Securities and Exchange Commission (SEC) says that recorded material must be kept for no less than three years with immediate access for two years. Records must be serialized and have the time-date for the required retention period on the storage media. Read more about SEC compliance.

- MiFID II compliance: Europe – The Markets in Financial Instruments Directive (MiFID II) specifies that any conversation made that might result in a transaction, must be recorded. Customers have the right to access to copies of recordings and records, and these recordings should be readily accessible. Recordings must be retained as evidence for a minimum period of five years. Read more about MiFID II compliance.

Penalties for non-compliance

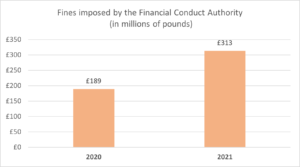

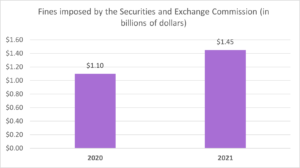

Regulators such as these are focused on protecting consumers and ensuring firms operate with integrity. Substantial fines are imposed on firms who are aware of their failure to record interactions accurately and effectively – both spoken and written – but continue to handle transactions.

General recording assurance best practice

Given that recordings need to be made available with little notice, this poses the following technical question: Are the call recordings easily identified with unique search criteria such as the traders or agent’s ID? If not, how will a particular call recording be identified over and above any other?

There is now more demand than ever for assurance-based solutions, both because regulators like the FCA have powers to penalise both firms and individuals for non-compliance, but also because it is good practice to help protect your consumers.

Knowing you have a call recording problem

So, we have seen how recordings need to be kept both for compliance and quality reasons, but how to you ensure these recordings are up to scratch?

As call and interaction recording is a passive function, most firms will be unaware that they have had an issue with the recording until it is too late. For example, in the case of a consumer dispute which leads to the requirement to play back the call, it is only at that point they might realise that the recording quality is garbled or cuts off partway through. The other scenario is that a small percentage of calls are not recorded due to technical issues, but the firm is unaware that the recoding has completely failed until they try to find the recording and realise it is not there.

Typical quality assurance issues and their solutions

Problems that a financial institution might face with recording assurance generally fall into the following categories:

- Legal requirements to record calls.

- System integrity concerns.

- Manual, costly validation process.

- Difficulties fault-finding.

Possible solutions for these include the following:

- Integrating your communications system with automated testing software to check for quality issues.

- Orchestrate the restricted sharing of recordings for testing purposes.

- Surface actionable insights by using quality monitoring software.

How Nectar can help with recording assurance

By working with Nectar, you can be safe in the knowledge that your calls are being recorded properly and that the quality of each interaction is being assessed. Nectar’s CX Assurance application proactively monitors recording and trading platforms, polling each channel to check it is being captured by the recording application. It then analyses the audio quality from each of the recordings to validate that it is acceptable and immediately flag any potential issues.

This proactive monitoring enables our customers to immediately identify issues, work to address them and then notify the required authorities that they may be in breach of local compliance regulations – thus protecting the business from the threat of large fines from local authorities.

We guarantee:

- Assure compliance – by assuring that you capture every interaction all the time and notifying you when any potential gaps in your compliance obligations are identified.

- Assure Quality – in each of your interactions with customers – meeting both compliance needs and ensuring exceptional CX.

For a full breakdown of how Nectar can help you record and assess your call quality, contact us today.